Successful Loan Fundings

Single Family Residence

$650,000

1st TD secured by a 1,320 sq. ft. SFR in Mission Viejo, CA

(Broker Arranged)

- Emergency Cash Out Refinance

- CLOSED IN 6 HOURS FROM LOI

- 55% LTV

- Term: 12 months

$1,180,00

1st TD on a 2,365 sq. ft. SFR in Santa Ana, CA

(Borrower Direct)

- 80% Loan to Purchase

- Fix and Flip

- Term: 15 months

$1,712,000

1st TD on a 2,011 sq. ft. SFR in Newport Beach, CA

(Borrower Direct)

- 80% LTV

- Purchase Financing

- Fix and Flip

- Term: 12 months

$1,200,000

1st TD on three SFR’s in Riverside, CA

(Borrower Direct)

- 65% LTV

- Cash Out Refinance for the purchase of additional investment property

- Closed concurrently with an additional loan on additional property held in a separate trust

- Term: 12 months

$1,872,500

1st TD on a 5,000 sq. ft. SFR in Tustin, CA

(Borrower Direct)

- 70% LTV

- Cash Out Refinance for the purchase of additional investment property

- Closed a secondary loan for the investment property purchase concurrently with this loan

- Term: 12 months

$1,960,000

1st TD on a 2,322 sq. ft. SFR on an 8,800 sq. ft. lot in Newport Beach, CA

(Borrower Direct)

- 75% LTV

- Fix and Flip

- Closed on a wholesale deal

- Multiple loans outstanding with the same borrower

- Term: 12 months

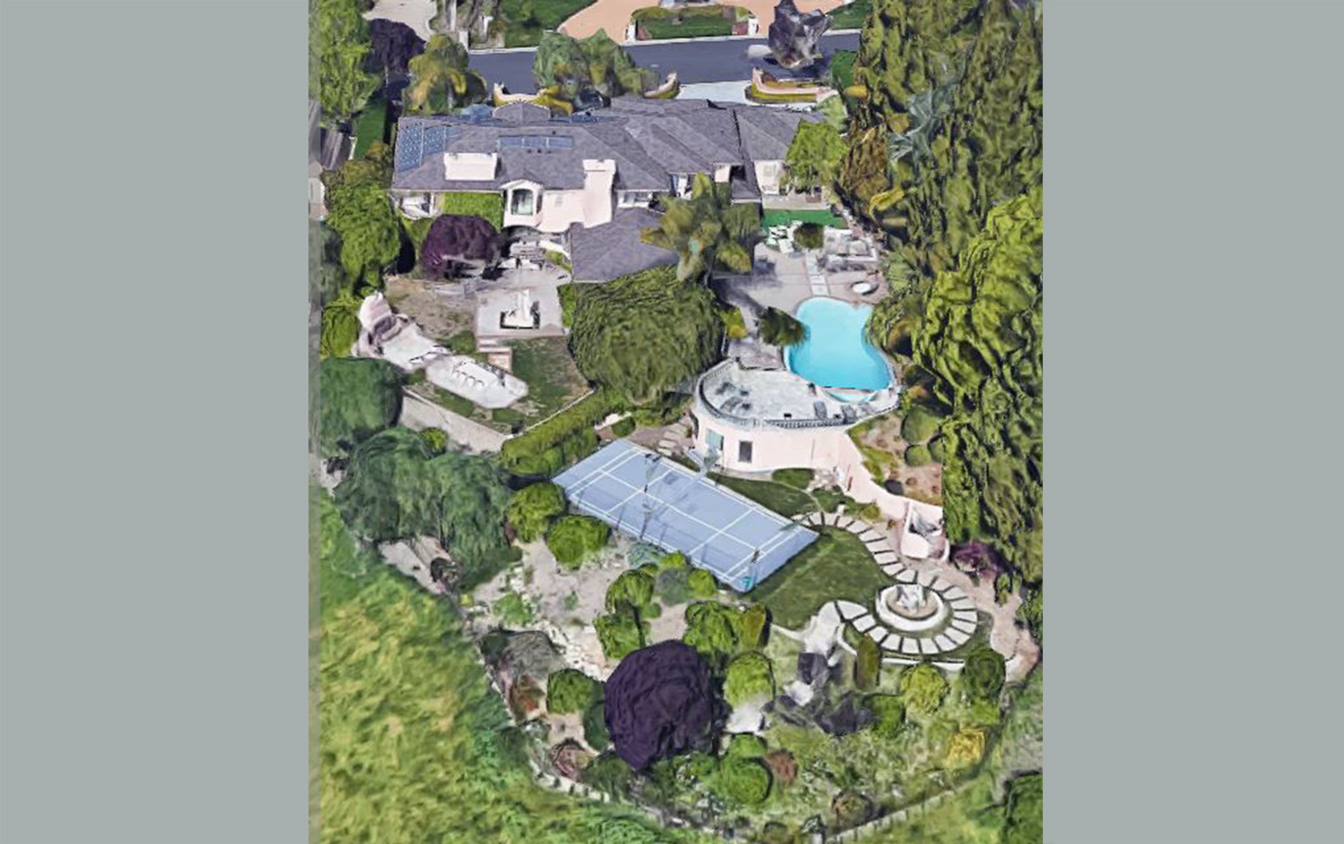

$4,750,000

2nd TD secured by a 4,642 sq. ft. SFR in Corona Del Mar, CA

(Borrower Direct)

- Cash out for business purposes

- 65% CLTV

- Worked with borrower’s attorney on loan document requests

- Utilized an appraisal ordered by a different lender

- Term: 12 months with 2 options to extend for three months

$772,000

1st TD on a 1,231 sq. ft. luxury condo in Newport Beach, CA

(Borrower Direct)

- 80% LTV

- Fix and Flip

- Closed on a wholesale deal

- Fixed Rate

- One week close

- Term: 12 months

$775,000

2nd TD secured by a 2,772 sq. ft. SFR in Newport Coast, CA

(Borrower Arranged)

- Cash out Refinance of HELOC

- 80% CLTV

- Cash used for borrower’s business liquidity needs

- Borrower contact to close in two weeks

- Appraisal received in two days allowing GF Capital to provide firm commitment with no contingencies

- Term: 9 months

$3,900,000

1st TD secured by a 5,288 sq. ft. luxury residence in Danville, CA

(Borrower Direct)

- Cash Out Refinance

- Funds used to support the short-term goals of the borrower’s primary business

- Loan to Family Trust

- Cross-default provision to support loans on multiple properties in different trusts

- Term: 12 months with 1 six month option to extend

$1,550,000

2nd TD secured by a 5,200 sq. ft. custom luxury SFR in Newport Beach, CA

(Borrower Direct)

- Construction Financing

- Lending against agreed upon construction budget

- Interest Reserve to meet borrower’s liquidity needs

- Term: 15 months with 1 six month option to extend

$4,200,000

1st TD on waterfront SFR in

Newport Beach, CA

(Broker Arranged)

- Co-op ownership structure

- 50% LTV

- Cash Out to support business during COVID

- Quick preparation of unconventional security agreements and security instruments given unique ownership structure of the home

- Coordinated directly with borrower counsel to insure smooth transaction

- Term: 18 months

$1,640,000

1st TD secured by a 4,431 sq. ft. single family residence on a 21,875 sq. ft. lot in Rancho Mirage, CA

(Borrower Direct)

- Purchase Financing

- Fix and Flip Transaction

- Quick Close

- Pre-approved borrower for a maximum LTV prior to entering into purchase contract

- Term: 12 months

$1,137,500

1st TD secured by a 3,014 sq. ft. SFR in Camarillo, CA

(Borrower Direct)

- Purchase financing

- 65% LTV

- Financed the down payment by taking collateral in a separate property owned by same borrower

- Term: 12 months with 1 six month option to extend

$4,400,000

1st TD on two waterfront SFR’s in Huntington Beach, CA

(Borrower Direct)

- 77% LTV

- Allowed borrower to exercise option to purchase

- Concurrently funded adjacent properties with a cross default provision

- Loan made to Family Trust

- Term: 18 months with 1 six month option to extend

$2,775,000

1st TD on new construction luxury SFR in Newport Beach, CA

(Borrower Direct)

- 70% LTV

- Provided funding to complete the project

- Fixed Rate

- One week close

- Term: 9 months

$4,100,000

1st TD on 7 new construction townhomes in Los Angeles, CA

(Broker Arranged)

- 60% LTV

- Construction ongoing; 90% complete

- Bridge to completion and marketability

- Comfortable release price structure

- Solved title issues associated with ongoing construction

- Interest Reserve

- Term: 12 months with 2 three month options to extend

$1,325,000

1st TD on 2,400 sq. ft. SFR in Huntington Beach, CA

(Borrower Direct)

- 70% LTV

- One week from LOI to close

- Purchase Money

- Allowed client to exercise option to purchase

- Term: 12 months

$1,350,000

2nd TD secured by a SFR in

Ladera Ranch, CA

(Broker Arranged)

- Cash out for working capital for borrower’s primary business

- Borrower was business entity

- Two weeks from inquiry to close

- 70% CLTV

- Behind a $1,590,000 1st Trust Deed

- Term: 24 months with 1 six month extension option

$1,450,000

1st TD on SFR Investment Property on Balboa Island, CA

(Past Client Referral)

- 70% Loan to Value

- Loan made to Family Trust

- Proceeds used to repurchase home AFTER trust deed sale

- Helped save beach house in Family for 50 years

- Limited documentable income/assets

- Term: 12 months

$920,000

1st TD on 1,900 sq. ft. SFR in

Yorba Linda, CA

(Borrower Direct)

- Fixed Rate while Fed Funds at 0-0.25%

- Closed the loan prior to receipt of appraisal

- Fix and flip transaction

- Closed in less than a week with repeat borrower

- Term: 9 months

$2,400,000

1st TD secured by a “Historical Residence” on a large-lot in

West Hills, CA

(Broker Arranged)

- Refinance and Cash Out for development

- 50% Loan to Value

- Special Purpose Property

- Loan made to family trust

- Term: 12 months with 2 six month options to extend

$492,800

1st TD on 1,765 sq. ft. SFR in Yosemite, CA

(Borrower Direct)

- 67% LT

- Two weeks from LOI to close

- Purchase Money

- Vacation rental property

- Term:12 months with 1 six month option to extend

$350,000

2nd TD on SFR Investment Property in Dana Point, CA

(Borrower Direct)

- All cash out

- 65% Combined Loan to Value

- Cash used to purchase additional property

- Three weeks from start to close

- Limited documentable income/assets

- Term: 12 months with 1 six month option to extend

$630,000

2nd TD on a single family residence in Newport Beach/Balboa Island, CA

(Borrower Direct)

- Fully approved within 1 business day

- Loan funding not dependent on receipt of appraisal

- All cash out for business purposes

- Borrowing entity a family trust

- Minimal documentation required

- 75% Combined Loan to Value

- Term: 12 months with 1 six month option to extend

$328,000

1st TD secured by single family non-owner occupied home in

Mission Viejo, CA

(Borrower Direct)

- Loan made to estate

- 47% Loan to Value

- Funded in 10 days from initial request

- Funded prior to receipt of appraisals

- All cash out

- Facilitated the estate’s settlement

- Term: 9 months

$975,000

1st TD on a duplex in Redwood City, CA

(Broker Arranged)

- 69.6% LTV

- Loan used for property improvements

- Bridge to sale of property

- LOI remained outstanding and active while borrower set up the property in an LLC

- Term: 12 months

$1,000,000

2nd TD on 13,790 sq. ft. SFR on a 5 acre lot in Alamo, CA

(Broker Arranged)

- 45% CLTV

- Cash out for business purposes

- Accepted a borrower provided appraisal in lieu of a newly issued appraisal

- Funded prior to certificate of occupancy

- Worked with title on mechanics lien endorsement

- Two weeks from LOI to funding

- Term: 12 months with 1 six month option to extend

$1,500,000

2nd TD secured by two high end residences in West Los Angeles, CA

(Borrower Direct)

- All cash out

- Both investment properties without current cash flow

- Cross collateralized behind 1st TD for a flexible CLTV of up to 70%

- Less than two weeks from inquiry to close

- Funded prior to receipt of appraisals

- Term: 12 months with 1 six month extension option

$7,000,000

22 newly constructed attached townhomes in Fontana, CA

(Borrower Direct)

- 73% LTV

- Cross collateralized with adjacent lot slated for next phase of buildout

- Interest Reserve

- Release prices by floorplan

- Closed the loan quickly in between unit closings

- Extrapolated values to save on appraisal costs

- Term: 12 months with 1 six month option to extend

$835,000

1st TD on mixed use structure & 2nd TD on 10 New SFR’s in Riverside County, CA

(Borrower Direct)

- Worked with borrower on obtaining unusual title endorsement provisions

- Structured a dynamic repayment plan based on home sales

- All cash out to allow Borrower to purchase land for future development

- Collateral based loan

- Worked closely with borrower on timing of closing

- Term: 12 months with 1 six month option to extend

$1,050,000

1st TD on Investment SFR in

Laguna Niguel, CA

(Broker Arranged)

- 68% Loan to Value

- All cash out used to bolster business yearend financials

- Five days from start to close

- Lent to family trust

- Funded prior to receipt of appraisal

- Term: 12 months

$550,000

2nd TD on 5,300 sq. ft. SFR on a 20,000 sq. ft. terraced lot in Newport Beach, CA

(Broker Arranged)

- 67.5% LTV

- Used an appraisal recently ordered by borrower

- Cash out for business purposes

- Term: 12 months with 1 six month option to extend

$8,000,000

1st TD secured by two high end residences in Bel Air, CA

(Borrower Direct)

- All cash out

- 40% Loan to Value

- Two weeks from call to lend to funding

- Funded prior to receipt of appraisals

- Lent to trust

- Foreign National Guarantor

- Term: 24 months

$3,000,000

Cash Out First TD on SFR in La Canada-Flintridge, CA

(Broker Arranged)

- 55% Combined Loan to Value

- Over $1,000,000 cash out for business purpose

- Funded prior to receipt of appraisal

- Limited Income/Limited liquid assets

- Three weeks from start to close

- Term: 12 months

$650,000

1st TD secured by 1,300 sq. ft. condo in Newport Beach, CA

(Borrower Direct)

- Purchase Financing

- 58% LTV

- Loan made to Family Trust

- One week close

- Term: 12 months

$650,000

1st TD secured by an SFR in

Los Angeles, CA

(Borrower Direct)

- Cash Out

- No financials required due to conservative LTV

- International Borrower

- Funded prior to receiving appraisal

- Interest Reserve to meet borrower’s liquidity needs

- 1 week close from borrower’s go-ahead

- Term: 12 months with 1 six month option to extend

$5,600,000

1st TD on Ten New Construction SFR’s ranging between 3,100 sq. ft. and 3,400 sq. ft. in Riverside, CA

(Borrower Direct)

- 65% LTV

- Provided Interest Reserve in addition to paying off 1st and 2nd TD’s

- Reduced appraisal costs for the borrower

- This loan allowed the developer to start on the next project by paying off a preferred construction lender

- Structured fixed release prices per lot upon sale to new homeowners

- Low interest rate reserved for repeat borrowers

- Term: 12 months with 1 six month option to extend

$4,319,000

1st TD on 4,500 sq. ft. waterfront SFR in Huntington Beach, CA

(Borrower Direct)

- 72% LTV

- Provided favorable loan structure to assist in borrower’s ability to appropriately market the property for sale

- Term: 9 months

$500,000

2nd TD secured by a 2,879 sq. ft. SFR in Murrieta, CA

(Borrower Direct)

- Cash out for business purposes

- 75% CLTV

- Utilized a recently completed appraisal not ordered by lender

- Term: 12 months with 1 six month option to extend

Land

$5,000,000

1st TD secured by a 9.74 acre site fully entitled to build 298 apartments in Chino Hills, CA

(Broker Arranged)

- Purchase financing to exercise option to purchase

- Bridge to construction financing or sale

- Limited guaranty from borrower

- 50% LTVl

- Term: 18 months

$11,000,000

1st TD secured by 4 acres of industrial land entitled to build a 78,000 sq. ft. warehouse in Santa Fe Springs, CA

(Borrower Direct)

- Refinance

- Partially deferred loan related costs

- Concurrently closed with another loan to the same client on a separate property

- Environmental review completed by GF Capital

- 55% LTV

- Term: 16 months

$1,755,000

1st TD secured by a 40,000 sq. ft. residential lot in Malibu, CA

(Borrower Direct)

- Purchase financing to exercise option to purchase

- Pending city final approval on architecture and engineering

- Bridge to construction financing

- Provided option to finance construction costs

- Limited guaranty from borrower

- 65% LTV

- Term: 18 months

$1,075,000

1st TD secured by 10.15 acres in the process of being entitled for 48 single family homes Winchester, CA

(Borrower Direct)

- Purchase financing to exercise option to purchase

- Interest Reserve

- Limited guaranty from borrower

- 50% LT

- Term: 12 months with 1 six month option to extend

$5,300,000

1st TD secured by 8.25 acres entitled for 7 commercial parcels in Coachella, CA

(Borrower Direct)

- Horizontal and Vertical Construction Loan

- Revolving credit line

- Interest reserve included

- Included release prices for parcels under contract to be sold

- Easy draw process

- One appraisal to cover the scope of completed construction and values for each parcel

- Term: 18 months with 1 six month option to extend

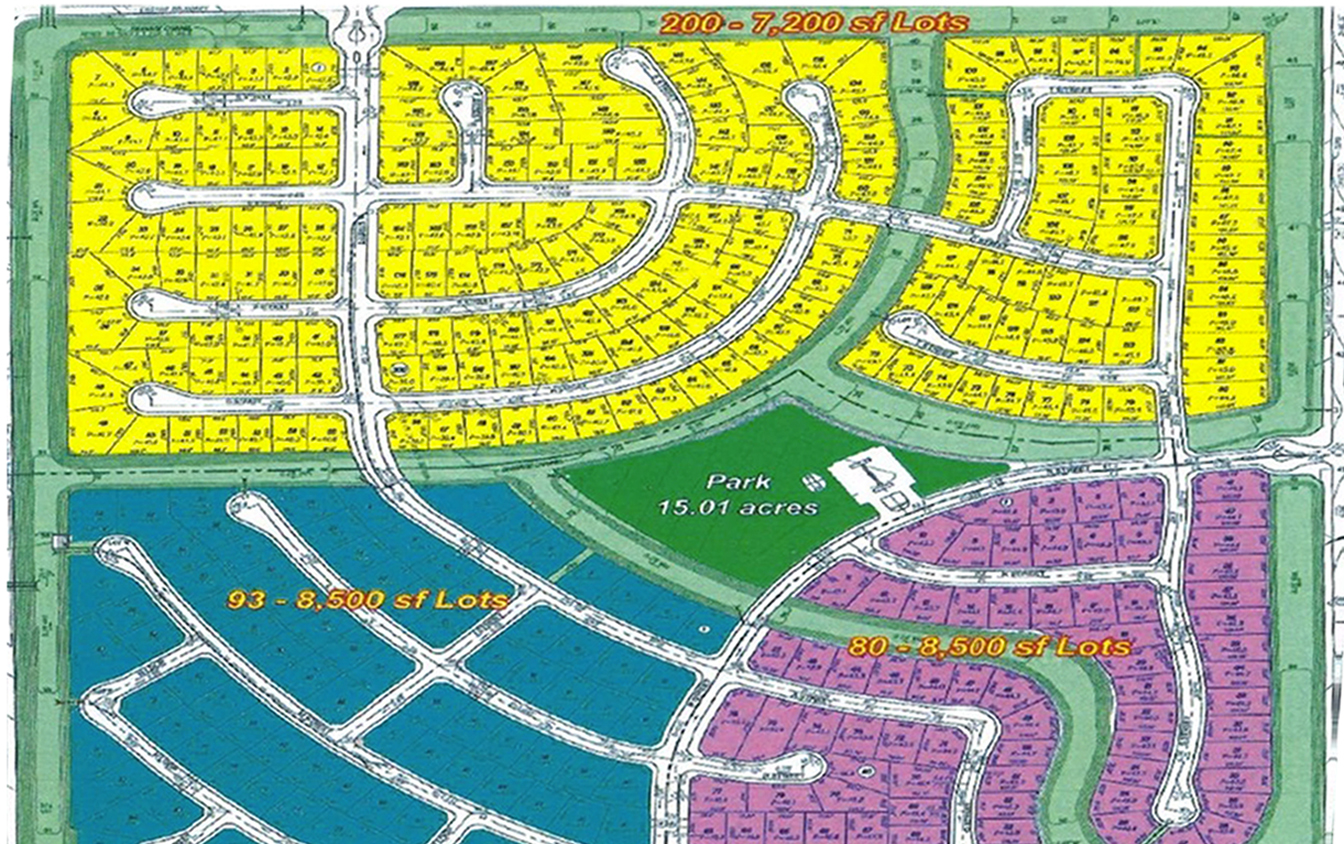

$7,835,000

1st TD secured by two lots entitled for residential development in San Bernardino County, CA

(Borrower Direct)

- Cash out refinance

- Horizontal development loan

- Interest reserve and construction holdback

- Bridge to construction financing

- Easy draw process

- One appraisal to encompass multiple properties and multiple value scenarios

- Term: 12 months with 1 six month option to extend

$3,400,000

1st TD on a 1.11 acre fully entitled apartment site in Canoga Park, CA

(Broker Arranged)

- 40% LTV

- Funded prior to receipt of appraisal

- Provided cash out for final engineering, bonding, and an interest reserve

- Worked around environmental remediation requirements

- Two weeks from LOI to close

- Term: 12 months with 1 six month option to extend

$3,350,000

1st TD on a 20 acre Development Project in Fallbrook, CA

(Broker Arranged)

- Incredibly complex transaction

- Dealt with significant legal hurdles

- Allowed borrower to move forward to maximize property’s potential

- Worked closely with borrower and multiple 3rd parties to customize loan structure to meet need

- 55% Loan to Value

- Established a one year interest reserve to assist in cash flow

- Term: 18 months with a 6 month option to extend

$7,200,000

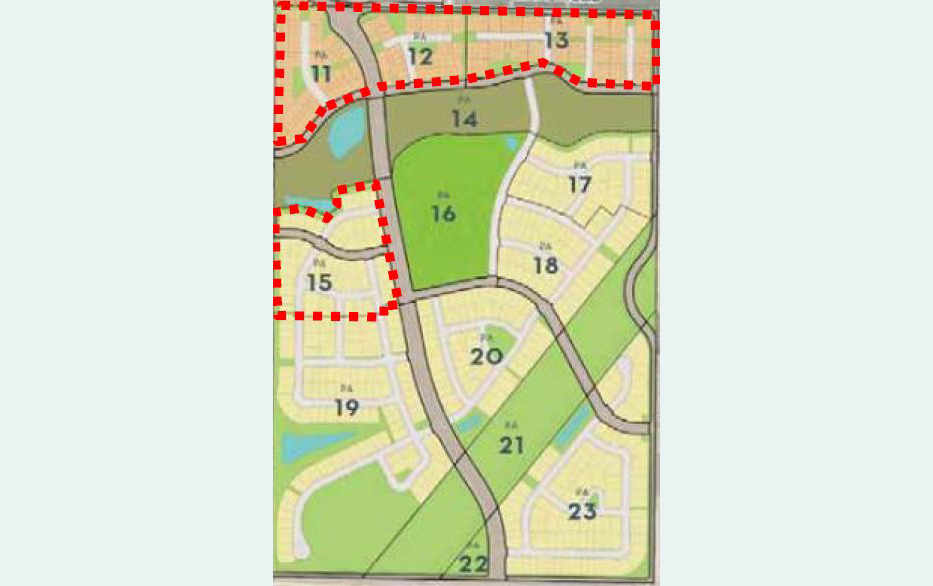

1st TD on an 80.39 acre site fully entitled for 152 SFR’s in Paso Robles, CA

(Broker Arranged)

- 30% LTV

- Used previously commissioned appraisal

- Purchase financing for client to take down the lots after years under an option agreement

- Provided release prices for each planning area upon sale to merchant homebuilders

- Underwrote the property based on a development agreement governing the entire master plan

- Term: 12 months with 1 six month option to extend

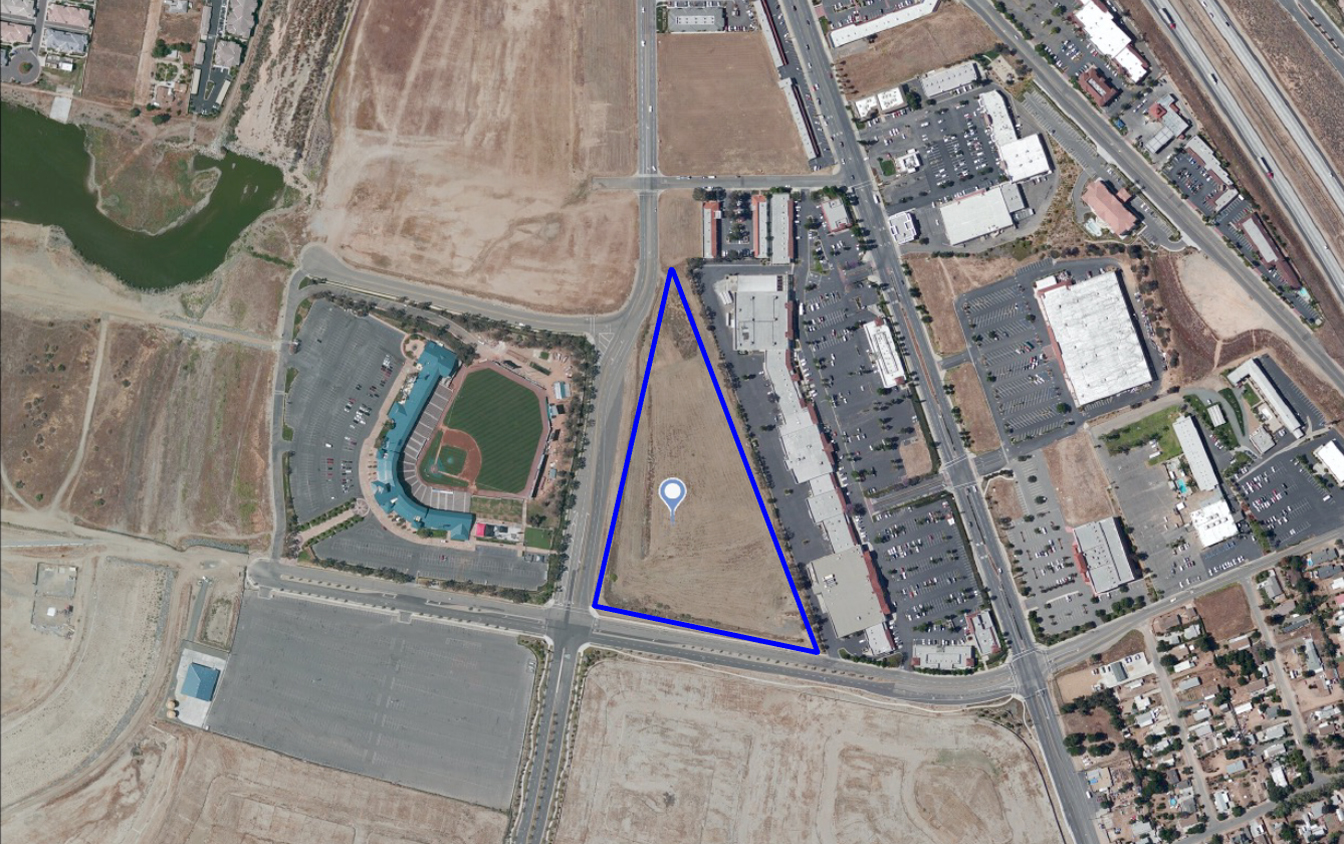

$4,500,000

Bridge Loan on 41 acres of Land with Approved Tract Map on 184 Lot SFR Tract Development in Jurupa Valley, CA

(Borrower Direct)

- 35% Loan to “As Is” Value

- Provided bridge while project is marketed for sale

- Allowed for a portion of equity to be pulled from development for other business purposes

- Proceeds allowed for sale of adjacent tracts to close and pay off bank debt

- Allowed borrower to maintain positive primary banking relationships

- Term: 12 months with 1 six month option to extend

$4,250,000

1st TD secured by 368 Fully Entitled SFR Lots on 158 acres cross collateralized to a 2nd TD on 73 acres in

Riverside County, CA

(Broker Arranged)

- Bridge to allow for re-entitlement

- Worked with borrower(s) on a complex ownership entity chain

- Gave consideration to complex offsite issues for area wide improvements that would advance the development of the property

- Allowed borrower to fully execute its existing option agreement to purchase the property

- Funded prior to receipt of appraisal

- Term: 16 months with 1 six month option to extend

$2,850,000

1st TD on 11.54 Acres of Fully Entitled Land in Lake Elsinore, CA

(Borrower Direct)

- Paid off existing note and provided an additional $580,000 of working capital

- Provided funds to allow for the continued marketing of the project

- 50% Loan to Value

- Three weeks from start to close

- Complex structure to meet borrower’s needs

- Term: 12 months with a 6 month option to extend

$4,950,000

1st TD on a 6,480 sq. ft. lot entitled for a 5,924 sq. ft. high-end SFR in

Corona Del Mar, CA

(Broker Arranged)

- 50% LTV

- Refinanced multiple liens on the property including the facilitation of a 2nd TD paydown/subordination

- Loan to single purpose LLC

- Two weeks from LOI to close

- Granted borrower cash flow flexibility in the form of a generous interest reserve

- Term: 12 months with 1 six month option to extend

$2,750,000

1st TD on 138 Fully Entitled Lots in Riverside County, CA

(Borrower Direct)

- Terms provided for up to 55% loan to appraised value

- Provided funds for refinancing and cash out for final engineering

- Loan to single purpose LLC

- Terms provided for funding prior to receipt of appraisal

- Term: 12 months with 1 six month option to extend

$1,275,000

1st TD on Purchase of Commercial Property in San Jacinto, CA

(Borrower Direct)

- Funded in 4 days from request

- 75% Loan to Value

- Planned lender could not perform

- Avoided the loss of deposit

- Coordinate the close with guarantors in multiple locations

- Term: 6 months

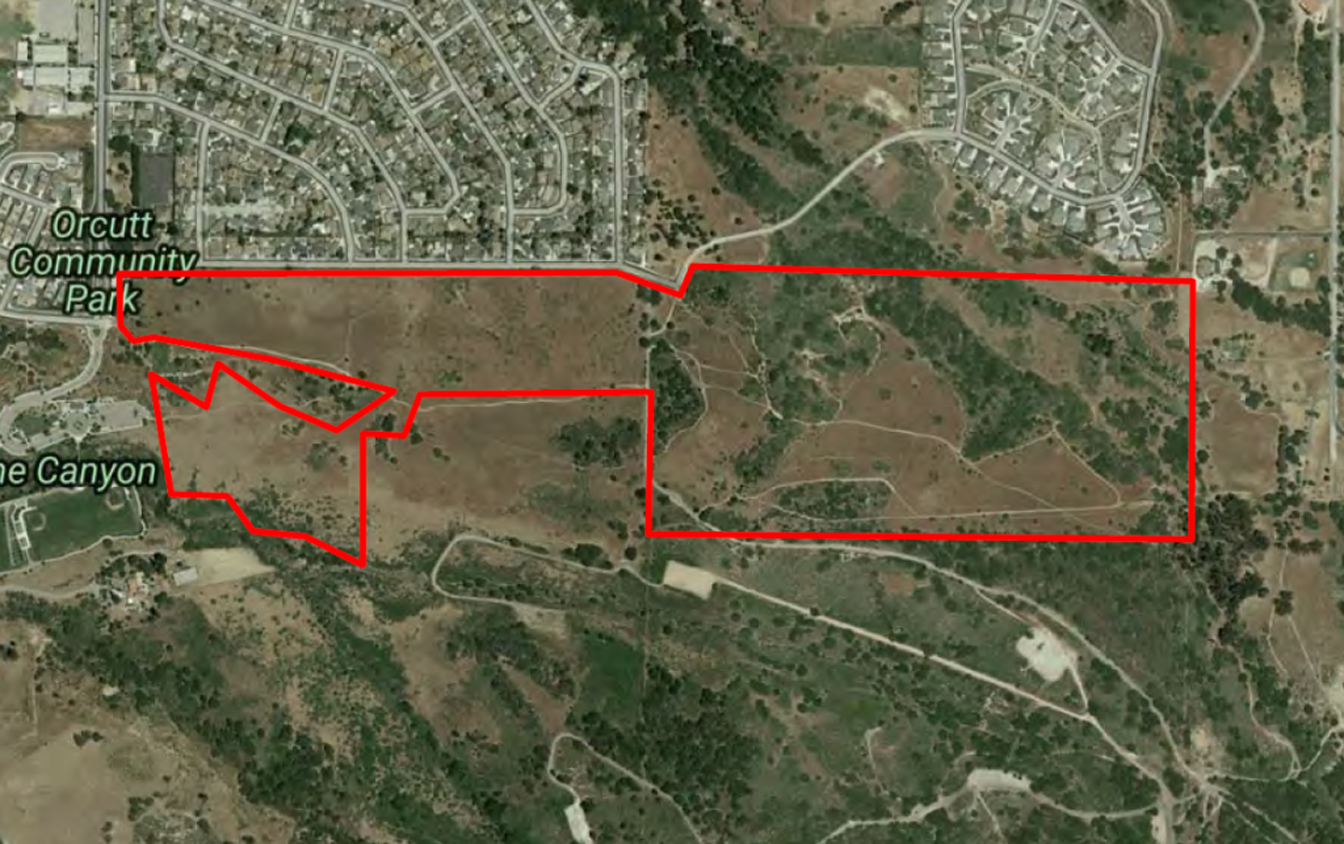

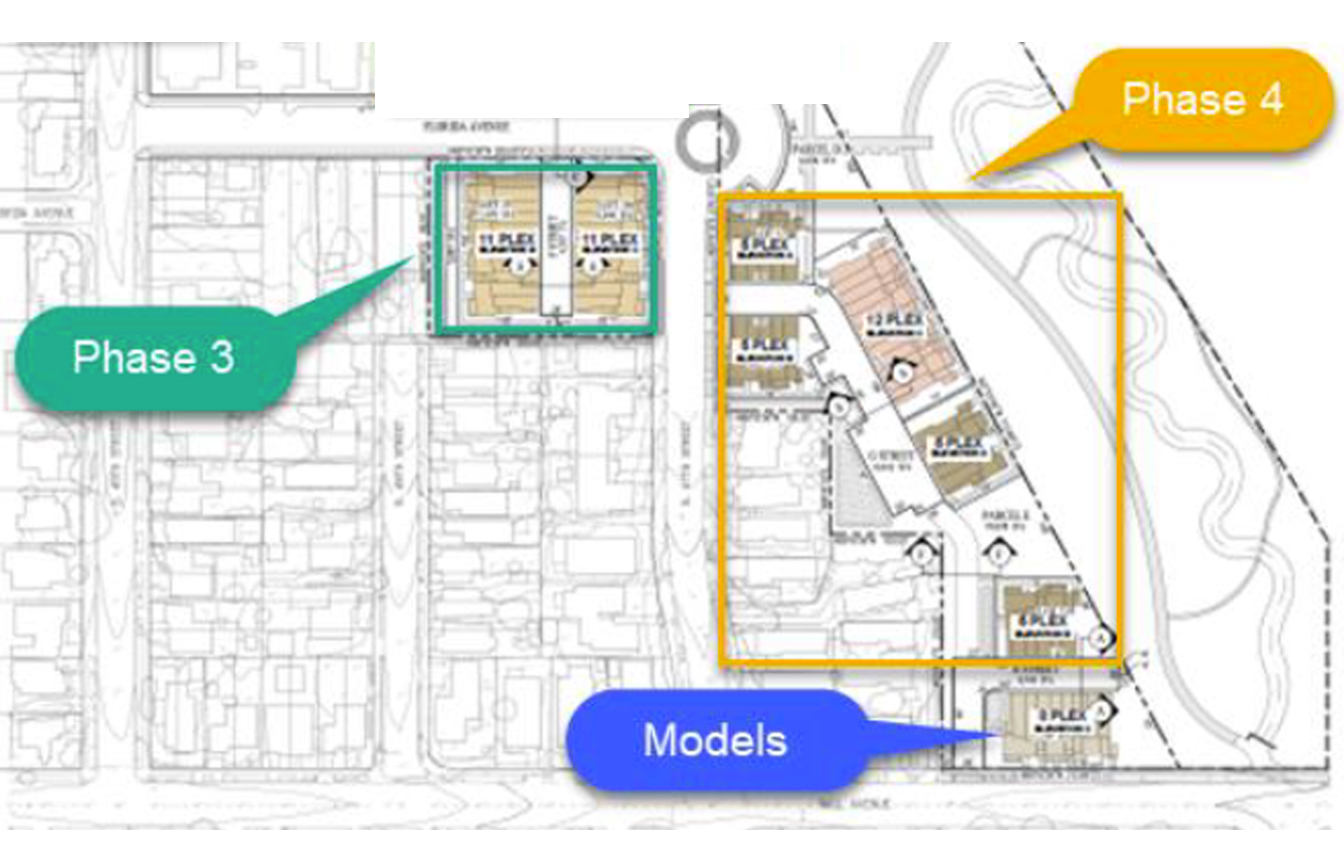

$7,500,000

Bridge Loan on Entitled Land for SFR Tract Development in Orcutt, CA

(Borrower Direct)

- 55% Loan to Value

- Provided bridge to construction loan after land loan matured

- Brokered an additional $4,500,000 on same project with concurrent close

- Established partial release prices to accommodate borrower’s needs

- Allowed borrower to maintain positive primary banking relationships

- Term: 12 months

$2,700,000

1st TD on 16 acres for the development of 129 SFR’s in Paso Robles, CA

(Borrower Direct)

- 22.7% LTV

- Repeat Borrower

- MAI Appraised

- GF Capital became comfortable with the master planned infrastructure and parcel map recordation

- Purchase Money with Interest Reserve

- Term: 18 months

$2,400,000

1st TD on Entitled 4.55 Acre Parcel in Soledad, CA

(Past Client)

- 65% Loan to Value

- Refinance Purchase Money First

- Additional $1 million cash out

- Two weeks from start to close

- Funded prior to receiving final appraisal

- Term: 12 months with 1 six month option to extend

$3,750,000

1st TD on 4 parcels with existing multi-family units entitled for 84 newly constructed multi-family units in

Los Angeles, CA

(Broker Arranged)

- 50% LTV

- Holdback of funds to be dispersed when needed to cover project related expenses

- Multi-faceted appraisal ordered to cover multiple exit strategies

- Due Diligence included a review of all project expenses to date for reimbursement eligibility

- Existing structures are inhabitable

- Term: 12 months with 1 six month option to extend

$4,750,000

1st TD on a Development Project in Richmond, CA

(Broker Arranged)

- Worked closely with borrower, the City and various constituents to ensure a smooth close

- 40% Loan to Value

- Complex title issues to resolve

- Extended commitment to lend through lengthy seller delays

- Bridge to construction loan

- Subject to a Development Agreement

- Term: 12 months with 1 six month option to extend

$3,100,000

1st TD on 4.52 acres across 5 contiguous parcels of unentitled land in

Petaluma, CA

(Borrower Direct)

- 60% LTV

- Purchase Money

- Bridge to entitlement/construction financing

- Proposed project for 41 townhomes and 15 SFR’s

- Facilitated obtaining an appraisal on behalf of client

- Term: 12 months with 1 six month option to extend

$5,000,000

1st TD on 6.91 acres entitled for 141 three story townhomes in Chula Vista, CA

(Borrower Direct)

- 55% LTV

- Purchase Money Financing

- Allowed the borrower to exercise its option to purchase the property

- Bridge to sale of property to a merchant builder

- Term: 9 months with 1 six month option to extend

$550,000

1st TD secured by a 16,128 sq. ft. vacant lot in Anaheim, CA

(Borrower Direct)

- Cash Out

- 62% LTV with a cross-default provision

- Analyzed the borrower’s schedule of RE to provide multiple debt service scenarios based on liquidity needs.

- Repeat borrower

- Term: 18 months with 1 six month option to extend

COMMERCIAL

$3,640,000

1st TD secured by two commercial properties (retail and auto repair) in Riverside County, CA

(Borrower Direct)

- Cash out for ancillary investment purposes

- 65% LTV

- Cross collateralized both properties and concurrently closed a cash out against both properties under the same ownership

- Term: 18 months with 1 option to extend for six months

$8,325,000

1st TD on a 48,721 sq. ft. multi-tenant office building in Irvine, CA

(Borrower Direct)

- Purchase financing

- 65% LTV

- Owner occupied

- Bridge to refinance

- Competitively priced based on the exit strategy

- Term: 10 months

$1,470,000

1st TD on a 6,253 sq. ft. office condo in Aliso Viejo, CA

(Borrower Direct)

- Purchase financing

- 70% LTV

- Owner occupied

- Bridge to refinance

- Utilized the appraisal ordered by the conventional lender intending on refinancing the loan

- Term: 16 months

$2,480,000

1st TD secured by a 3,725 sq. ft. restaurant/bar in Fullerton, CA

(Borrower Direct)

- Purchase financing

- Bank REO transaction

- Property needs rehabilitation and re-establishment of liquor license

- Borrower has significant experience in the industry with a prove track record of success and growth

- Cross default provision with adjacent property also financed by GF Capital

- Term: 12 months with 1 six month option to extend

$7,840,000

1st TD secured by a 23,781 square foot Motel in Bellflower, CA

(Broker Arranged)

- Purchase financing

- Bridge to reconditioning and “flagging” with a highly regarded hospitality brand

- Accommodated multiple investors acting as the borrower for one loan

- Term: 18 months with 1 six month option to extend

$4,250,000

1st TD construction financing for a 3,765 sq. ft. automated car wash on a 34,400 sq. ft. lot

(Borrower Direct)

- 60% LTV

- Interest Reserve provided to manage cash

- Used previously commissioned appraisal by Newmark Night Frank to save on costs

- Worked with title on recent lot merger, lot division, and mechanics lien endorsement

- Term: 12 months with 1 six month option to extend

$2,531,250

1st TD secured by a Boutique Hotel in Palm Springs, CA

(Borrower Direct)

- Purchase transaction

- Funded 74% of purchase price

- Loan to property specific LLC

- Non-traditional underwriting of specialized asset class with value add characteristics

- Funded prior to completion of appraisals

- Term: 12 months with 2 six month extension options

$1,200,000

1st TD Secured by Commercial Office in Ontario, CA

(Financial Advisor Referral)

- 75% Combined Loan to Value

- All Cash Out

- One week from start to close

- Funded prior to receipt of appraisal

- Allowed borrower to support business cash flow needs

- Term: 12 months

$1,932,000

1st TD secured by a 3,633 sq. ft. retail building in Costa Mesa, CA

(Borrower Direct)

- Cash Out Refinance

- Financed four separate borrowers under one transaction

- Property under renovation at time of funding

- Term: 18 months with 1 six month option to extend

$1,375,000

1st TD on 11,700 sq. ft. dual tenant retail building in Clovis, CA (Broker Arranged)

- 65% LTV

- Two weeks from LOI to close

- Refinance with Interest Reserve

- COVID impacted business

- Bridge to full reopening of business operations

- Term: 16 months

$2,975,000

1st TD on a Commercial Office building consisting of 21,840 sq. ft. in rentable space in San Diego, CA

(Broker Arranged)

- 70% LTV

- Last-minute loan document modifications due to borrower’s preferred title entity

- Re-margined the loan amount based on a quick turn around appraisal

- Non-stabilized current rent roll

- Term: 18 months with 1 six month option to extend

$1,012,500

11st TD secured by a single-tenant Commercial property in Lakewood, CA

(Borrower Direct)

- Cash Out

- 75% LTV with a cross-default provision

- Re-margined the loan based on appraisal

- Analyzed the borrower’s schedule of RE to provide multiple debt service scenarios based on liquidity needs.

- Term: 18 months with 1 six month option to extend

$1,800,000

1st TD secured by a Boutique Hotel in Palm Springs, CA (Borrower Direct)

- Purchase transaction (funded 75% of purchase price)

- Loan to property specific LLC

- Non-traditional underwriting of specialized asset class with value add characteristics

- Funded prior to completion of appraisals

- Reverse 1031 transaction

- Term: 12 months with 2 six month options to extend

$2,715,000

1st TD secured by a 12,960 sq. ft. multi-tenant Commercial property in Anaheim, CA (Borrower Direct)

- Cash Out

- 75% LTV with a cross-default provision

- Terms to allow for flexible timing of loan draws

- Loan to single purpose entity

- Term: 18 months with 1 six month option to extend

SPECIAL PURPOSE

$7,000,000

1st TD on a newly constructed special purpose 40,000 sq. ft. industrial building on 4.68 acres in Adelanto, CA

(Borrower Direct)

- 50% LTV

- Cash Out Refinance

- Extra value given to extraordinary fixtures

- Provided borrower with a holdback of funds to be disbursed upon completion of milestones

- Owner occupied; Business will not generate revenue for the first six months from loan inception

- Term: 18 months with 1 six month option to extend

$1,300,000

1st TD secured by 37.8 acres of special purpose property in Sylmar, CA

(Broker Arranged)

- Cash Out Refinance

- Property affected by fire; Required detailed coordination with an MAI appraiser

- Included the resolution of title issues in loan documents to move the loan closing forward

- Bridge to construction loan; Provided financing for necessary land development and infrastructure

- Interest Reserve to meet borrower’s liquidity needs

- Term: 12 months with 1 six month option to extend

INDUSTRIAL

$2,850,000

1st TD secured by a 9,460 sq ft industrial flex in Brea, CA

(Borrower Direct)

- Purchase Financing

- 75% Loan to Purchase

- Owner user building purpose

- Term: 24 months

$5,400,000

1st TD on a 40,200 sq. ft. light industrial facility in Commerce, CA

(Broker Arranged)

- 65% LTV

- Refinance

- Consolidated non real estate and real estate debt

- Bridge to sale of property

- Term: 12 months with 1 six month option to extend

$1,500,000

1st TD on a 16,000 sq. ft. industrial building on a 33,667 sq. ft. lot in Anaheim, CA

(Broker Arranged)

- 37.5% LTV

- Cash Out Refinance

- Bridge to sale of property

- Provided the liquidity necessary for the business to get through a period of reduced sales

- Term: 16 months

$3,470,000

Purchase Money First TD on Industrial Building in West Sacramento, CA

(Attorney Referral)

- 70% Combined Loan to Value

- Phase 1 issues to resolve

- Special Use Building

- Allowed secondary financing for property improvements

- Worked with borrower through multiple closing issues

- Term: 18 months with 1 six month option to extend

$5,000,000

1st TD & 2nd TD on Three Industrial facilities in Irvine & Santa Ana, CA

(Attorney Referral)

- Cross Collateralized against three properties with three related entities

- Cash out to close escrow on new operating facility

- One week from call to funding

- Based collateral value on existing sales contracts in lieu of appraisals

- Flexible alternatives with respect to loan amount (increased loan amount two days prior to close)

- Term: 3 months with 1 six month option to extend

$3,500,000

35,000 Square Feet of Industrial Space on 2.37 Acres in Santa Fe Springs, CA

(Borrower Direct)

- Three weeks application to close

- Structured to facilitate 1031 Exchange

- Closed prior to receipt of appraisal

- Draw schedule established to stage advances for property improvement to save interest costs

- Building being repositioned to accommodate a business relocation thus no cash flow during this period

- Term: 12 months with 1 three month option to extend

$500,000

2nd TD on Two Light Industrial facilities in Rialto & Fontana, CA

(Broker Referral)

- Collateralized by two properties under one single purpose LLC entity

- Collateral release price structure negotiated for both properties encumbered by the loan

- Cash out for business purposes

- Funding prior to appraisal

- Terms for additional advances based on combined appraisal valuation

- Term: 12 months with 1 six month option to extend

$1,000,000

2nd TD on 28,000 sq. ft. Industrial Building in Lake Forest, CA

(Borrower Direct)

- 45% CLTV

- Loan made to a property specific LLC

- Structured the loan as a non-revolving line of credit

- Funding was not contingent on receipt of appraisal

- Interest only charged on outstanding balance

- Term: 24 months

Fix and flip

$307,200

1st TD on 600 sq. ft. Condo in Los Angeles, CA

(Borrower Direct)

- Fixed Rate while Fed Funds at 0-0.25%

- Closed the loan prior to receipt of appraisal

- Property in disrepair at time of closing

- Fix and flip transaction

- Closed in less than a week with repeat borrower

- Term: 9 months

$604,800

1st TD on 5,307 sq. ft. SFR in Corona, CA

(Borrower Direct)

- Favorable LTV due to the Bank REO

- Provided quick terms for a quick closing

- Closed the loan prior to receipt of appraisal

- Fix and Flip transaction

- Term: 9 months

$856,800

1st TD on 3,369 sq. ft. SFR in Carlsbad, CA

(Borrower Direct)

- Favorable LTV due to the Bank REO

- Provided quick terms for a quick closing

- Closed the loan prior to receipt of appraisal

- Fix and Flip transaction

- Term: 9 months

$2,500,000

2nd TD on partially completed Construction Project in

Manhattan Beach, CA

(Broker Arranged)

- 65% Combined Loan to Value

- All cash used to complete project

- Three weeks from start to close

- Funded prior to receipt of appraisal

- Limited liquid assets

- Term: 12 months with 1 six month option to extend

$2,500,000

Cash out to redevelop a single family estate in Hollywood Hills, CA that had been deemed uninhabitable by the city

(Broker Arranged)

- 65% Loan to “As Is” Value

- Provided bridge while project plans are being finalized

- 100% of the proceeds were cash out to reimburse the borrower who had paid all cash to secure the property on favorable terms

- Creative loan structure to maximize the return to the borrower

- Term: 12 months with 1 six month option to extend

$403,200

1st TD on 2,272 sq. ft. SFR in

Santa Clarita, CA

(Borrower Direct)

- Favorable LTV due to the Bank REO nature of the transaction with a repeat client

- Provided quick terms for a quick closing

- Closed the loan prior to receipt of appraisal

- Closed the loan with the eviction of current tenant in process

- Fix and Flip transaction

- Term: 9 months

Want to Connect?

Have our specialist

call you today

for more information

fast approval

Contact us and find out

in just 24 hours if you are

approved for a loan

Loan process

Let us clarify the process

and identify the documents

you will need